ID & Document Scan Verification

Melissa Identity Solution

Reduce Risk, Ensure Compliance and Keep Customers Happy

Identity fraud is one of the biggest issues organisations are facing today. The solution is to create a seamless end-to-end platform for organisations to onboard and safely keep track of customer data. Melissa’s Mult-Layered ID Document Scan Verification is a service that enables businesses to confidently onboard new customers with cutting edge technology integrating the use of AI, biometrics and machine learning.

- Proof of life Scans face and checks for eye movement to establish if the person behind the ID is real

- Document Verification Capture ID & Document data using Machine Readable Zone (MRZ) and Optical Character Recognition (OCR) to extract crucial information from passports, utility bills, driver’s licence, etc

- Biometrics Uses powerful smart facial recognition and facial comparison algorithms to match a person’s selfie to their photo ID

- Address Verification To additionally add an extra level of protection where a person’s name and address is extracted and verified against multiple databases to confirm a full address match

Implement Safe and Secure Customer On-Boarding and Know Your Customer (KYC) Rules

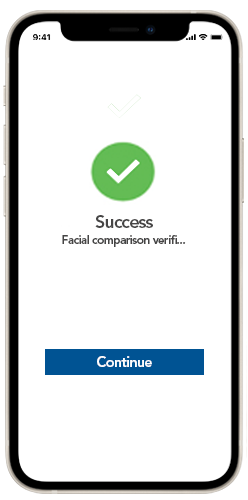

Melissa’s ID Document Scan and its multi-layered verification allows businesses to successfully enable robust security giving a smarter and more secure alternative to Knowledge Based Authentication (KBA). Detect fraud seamlessly and obtain a complete user verification in a simple 1-2-3-4 process.

- Smooth Customer Journey: Verify the identity of customers with ease with a simple 3 step process all in less than 60 seconds.

- High Accuracy in Data Extraction: A reliable solution that captures and extracts crucial information needed for KYC compliance.

- Remote On-boarding: Users can scan and upload from any remote location including the comfort of their own home.

- Full Audit Trail: Generates a customer due diligence report which is stored securely.

- Multi-System Workflow: Integrates with all android, iOS and PC systems as well as web form, checkout, mobile applications.

- Efficient Streamlined Process: The included business portal allows all submitted documentation to be reviewed and approved in less than a minute.

How Melissa's ID Document Verification Service Works

1 ID Document Scanning & Extraction

Using the power of Machine Readable Zone (MRZ) This automatically recognises the type of ID document being shown and supports more than 2000 ID templates from all countries worldwide, ensuring global authentication .

2 Biometrics & Optical Character Recognition

This algorithm will recognise a matchup between the user’s selfie and their ID image presented. This capability can identify over 60 facial features to distinguish changes between the selfie and the ID image including hair, makeup, age, hairstyle, positions in head pose and more.

3 Liveness Testing

This step will determine if a person is live and not a static photo or video representation of another individual. By confirming that the person is a real live person and preforming the previous steps of facial matching and document scanning, this confirms that the individual is the true owner of the documentation and the documentation is authentic.

4 Address Verification

This extra capability verifies the name to the address extracted, matching it against multiple databases to confirm that the full address is valid and there is a match, showcasing proof of address.

Melissa ID Document Verification Advantages

|

Other SaaS Vendors | |

|---|---|---|

| Out-Of-Box Ready to Use | No Customisation Capability | |

| Built, Tested & Integrates to Any Process | ||

| Easily Customisable | |

|

| Included Business Portal Enables More Control | ||

| Provides Access to Technical or Manual Checks | Limited Access to Technical Checks | |

| Avoids High Cost & Time with Complex Integration | May Need Significant Development Time | |

| Maintenance, Servicing & Upgrades Included | ||

| Highest pass rate on the market with 93% | ||

| API/SDK Availability | Complex API/SDK Integration | |

| Name to Address Match | ||

| Address Verification for 250+ Countries |

Explore Our Range of Identity Verification Solutions

Melissa’s identity verification utilises a range of industry-leading services, which are flexible and designed for organisations of all sizes, to meet KYC & AML compliance needs. Our additional identity verification solutions include:

Frequently Asked Questions

ID document verification is a process used to confirm the authenticity and legitimacy of an individual's identification documents, such as passports, driver's licenses, national ID cards, or other official documents. This verification process is commonly employed by various organisations, institutions, and businesses to ensure the identity of their customers or users, especially in online or remote interactions.

The primary purpose of ID document verification is to prevent identity fraud, where individuals might use fake or stolen documents to impersonate someone else. By verifying the authenticity of the presented ID documents, organisations can establish a higher level of trust and confidence in their interactions with customers or users, particularly in scenarios involving financial transactions, account registration, age verification, or access to sensitive information.

The process of ID document verification can involve various methods, including:

- Manual Inspection: Trained personnel examine the physical attributes and security features of the ID document to look for signs of tampering, forgery, or inconsistencies.

- Optical Character Recognition (OCR): Software technology is used to read and extract information from the document's text, such as name, date of birth, and other relevant details.

- Document Authentication Software: Advanced software tools and algorithms analyse the security features embedded in the ID document, such as holograms, watermarks, UV elements, or microprinting, to determine their authenticity.

- Facial Recognition: In some cases, the individual's face may be compared to the picture on the ID document to confirm that they are the rightful owner.

- Government Databases: Some organisations have access to government databases where they can cross-reference the information provided on the ID document with official records.

It is important to note that ID document verification should always be carried out in compliance with privacy regulations and data protection laws to ensure that the personal information of individuals is handled responsibly and securely. The verification process can vary in complexity depending on the organisation's requirements and the level of security needed for a particular service or transaction.

ID document verification is important for several reasons:

- Preventing Identity Fraud: Identity fraud is a significant concern in today's digital age. By verifying the authenticity of ID documents, businesses and organisations can reduce the risk of individuals using fake or stolen identities to access services, conduct financial transactions, or commit illegal activities.

- Establishing Trust: ID document verification helps establish trust between businesses and their customers or users. When individuals know that their identity is being verified, they are more likely to feel secure in their interactions and transactions with the organisation.

- Compliance and Regulatory Requirements: Many industries, such as financial services, healthcare, and government, are subject to strict regulations regarding customer identification and due diligence. Implementing robust ID document verification processes helps organisations meet these regulatory requirements and avoid potential legal issues.

- Protecting Sensitive Information: Certain services or access to sensitive information may require extra layers of security. By verifying the identity of individuals, organisations can ensure that only authorised users gain access to such data, reducing the risk of data breaches and unauthorised access.

- Age Verification: In industries where age restrictions apply, such as gambling, alcohol sales, or age-restricted content, ID document verification is essential to confirm that users meet the minimum age requirements.

- Preventing Account Takeovers: In online platforms and services, ID document verification can be used as an additional measure to prevent unauthorised individuals from taking over user accounts and engaging in fraudulent activities.

- Mitigating Financial Risks: Businesses offering credit or financial services can use ID document verification to assess the creditworthiness of applicants and reduce the risk of potential defaults or fraud.

- Enhancing Customer Onboarding: By streamlining the ID document verification process, organisations can enhance the customer onboarding experience, making it more convenient and efficient for users to access their services.

- Combating Terrorism and Money Laundering: In industries susceptible to money laundering or terrorism financing, verifying the identities of customers helps organisations comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

- Global Business Operations: For organisations operating internationally, ID document verification is crucial for dealing with customers and users from different countries, where identification formats and security features may vary significantly.

Overall, ID document verification plays a vital role in safeguarding businesses, customers, and sensitive data, while also contributing to a more secure and trustworthy digital environment.

An ID Document Verification service should be used in various situations and industries to enhance security, comply with regulations, and mitigate identity-related risks. Here are some common scenarios when an ID Document Verification service is beneficial:

- User Onboarding: When new customers or users register for an online service, platform, or application, ID Document Verification can be used to verify their identities and prevent fraudulent account creation.

- Financial Transactions: When new customers or users register for an online service, platform, or application, ID Document Verification can be used to verify their identities and prevent fraudulent account creation.

- Access to Sensitive Information: Industries dealing with sensitive data, such as healthcare, legal, or government sectors, can use ID Document Verification to ensure only authorised individuals access confidential information.

- Age-Restricted Services: Services or products with age restrictions, such as gambling websites, alcohol sales, or adult content platforms, can benefit from ID Document Verification to verify the age of users.

- Remote Services: In online or remote interactions, where face-to-face verification is not possible, an ID Document Verification service provides a secure way to confirm identities without physical presence.

- Compliance with Regulations: Businesses subject to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations need to verify the identities of their customers, and an ID Document Verification service can assist with this compliance.

- Rental or Accommodation Services: Rental agencies or accommodation providers can use ID Document Verification to authenticate potential tenants or guests and reduce the risk of rental fraud.

- Employment and Background Checks: During the hiring process, employers can use ID Document Verification as part of their background check procedures to ensure candidates' identities and credentials.

- Border Control and Travel: At airports, border crossings, or immigration checkpoints, ID Document Verification is essential for verifying the authenticity of travellers’ passports or other travel documents.

- Preventing Account Takeovers: Online platforms, social media sites, or cloud service providers can use ID Document Verification to protect user accounts from unauthorised access and account takeovers.

It is important to carefully consider the specific needs and requirements of the business or organisation before implementing an ID Document Verification service. Additionally, privacy and data protection regulations must be followed to ensure that user information is handled responsibly and securely during the verification process.

Helpful Resources