Partners

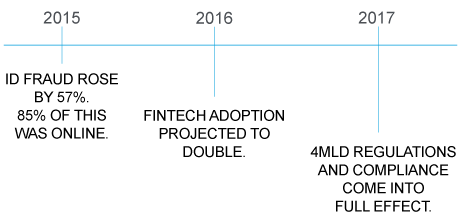

Consumers are increasingly conducting their financial affairs online. And, they desire a smooth, rapid sign-in process. This makes it increasingly difficult for businesses to manage risk and protect the business while meeting customer demands for convenience, speed, and simplicity.

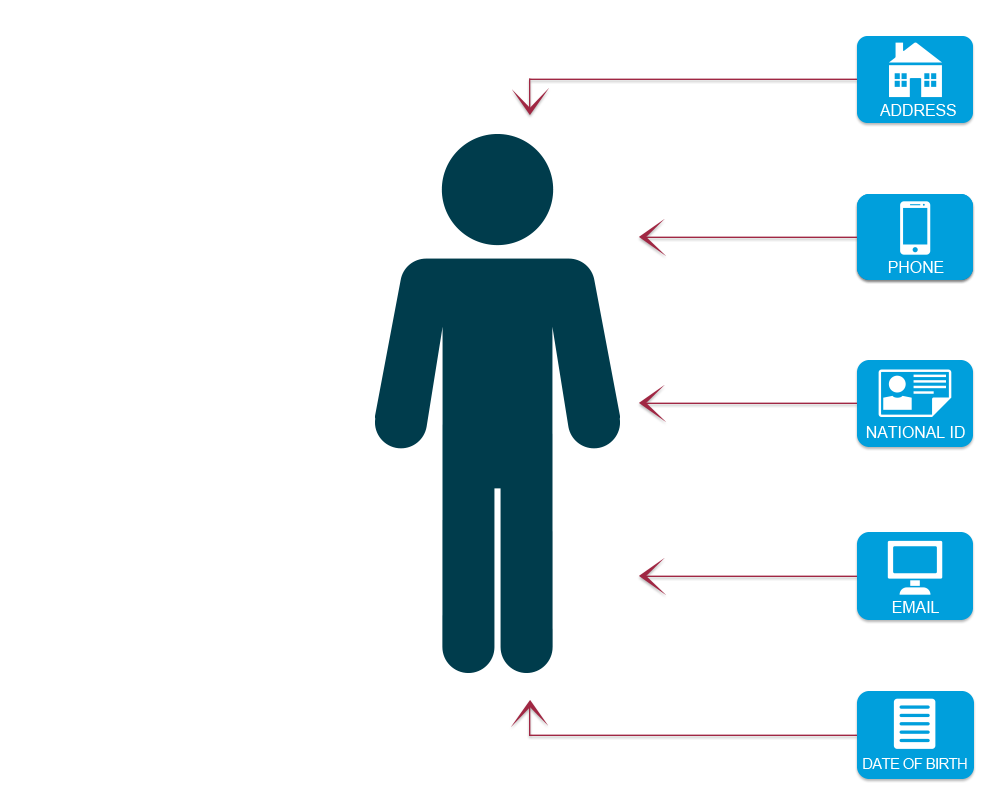

Now, more than ever, global organizations need to implement smarter, simpler KYC processes to improve the customer experience while protecting corporate assets. Melissa Global Intelligence meets this need.

The cost of doing thorough due diligence is high. But the cost of not doing it is even higher. Are you ready?

Melissa Global Intelligence offers a significant opportunity to retire costly legacy Compliance and KYC systems, reduce headcount for manual review, and avoid reputational risk with regulators and the general public. It’s a flexible solution you can tailor to meet your specific customer sign-up process and risk management requirements; ensuring an excellent customer experience while guarding against fraud and money laundering.

Melissa Global Intelligence provides powerful, real-time tools and services to achieve entity resolution and compliance in areas of Anti Money Laundering (AML), Fraud Prevention, Politically Exposed Persons, and with Bank Secrecy Act (BSA) regulations.

Melissa is a leading provider of identity assurance and data quality. Since 1985, our mission has been to help organizations across industries and across the world harness the value from all their data to find new revenue streams, operate more efficiently, deliver outstanding customer service, and minimize risk.